Table of Contents

An Overview Of the SARFAESI Act

Our country’s financial sector has been a major influence on economic growth. Every day the following sector has been yielding several efforts to make our economic aspect flourish through different verticals. The legal frameworks attached to commercial transactions fluctuated with the dynamic pace of commercial practices. Even the financial sector has rapidly reformed its structure to acquire good fame. As a result, the recovery pace of defaulting loans has decreased. The levels of nonperforming assets and financial institutions have raised significantly.

To effectively enlighten this serious concern, the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act has existed. The SAFAESI Act has enabled all the securing aspects through which the financial institutions and banking sector empowered itself.

What is SARFAESI Act?

The SARFAESI Act gives access to several banking institutions for auctioning residential and commercial properties to recover a loan when a borrower significantly fails to repay the loan amount. So, SARFAESI Act 2002 makes every bank to diminish their nonperforming assets with the help of recovery and reconstruction methods.

The SARFAESI Act implies that the following banks can seize the assets or property of the borrower without leading towards the court. However, this rule cannot be implemented for agricultural lands as SARFAESI Act is pertinent only for secured loans where banks can implement underlying securities like mortgages, hypothecation, pledge and more. The bank doesn’t require any court orders when the security is darted as fraudulent or invalid.

What is the Applicability Regarded In The SARFAESI Act?

Formerly, the Central Government has given rise to Narsimham Committees I ad II along with Andhyarujina Committee to verify the reforms done by banking sectors. The following committees sensed the requirement for new changes in the legal system. So, these committees have influenced the working proficiency of the SARFAESI Act in 2002. Here we have enlisted the applicability of the SARFAESI Act that you need to consider.

- Assisting the assets belonging to a bank without using underlying securities.

- The Reserve Bank of India oversees and registers Asset Reconstruction Companies.

- Charge Asset Reconstruction Companies for selling security receipts to make customers get approval for raising money.

- The financial assets will be transferred seamlessly by the ARC to acquire financial assets belonging to financial organizations.

- Presentation of several asset reconstructions registered under the RBI as a public financial organization.

- Signification of a borrower’s account as a nonperforming asset per the rules given in the guidelines published by RBI.

- The officers authenticity will work per the rights of a creditor for the rules implemented by the Central Government.

What Are The Features Of The SARFAESI Act?

Here we have enlisted all the features regarded in SARFAESI Act for your perusal:

- Reconstruction of the assets.

- Securitization of the financial properties or assets.

- Funding Securitization.

- Provisions related to SICA dilution.

- Plate provisions related to boiler.

- It will form specialized vehicles that is a reconstruction company or a securitization organization.

- Imposing security interests.

- The curation of a Central Registry to record securitization transactions.

What Are The Objectives Of SARFAESI Act?

Here we have given the major objectives handled by SARFAESI Act:

- It recovers the nonperforming assets channelized by banks and FISs effectively and quickly.

- It access the financial institutions to arrange an auction for the needed property or assets like residential or commercial premises whenever a borrower is not able to pay back the loan.

What Is The Role Of The SARFAESI Act?

SARFAESI Act has been ruling on several roles that helps a financial institution to embark on a successful route. Some of its essential roles are listed below:

- Rebuilds Financial Assets: SARFAESI enables proper actions to lead good management, sale, debt restructuring, settlement, per the governance of RBI.

- Securitizing Financial Assets: It purchases financial assets from issuance debentures, bonds, or agreement.

- Security Interest Enforcement: The following secured creditor can enforce the security interest without the assistance of the legal permissions.

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

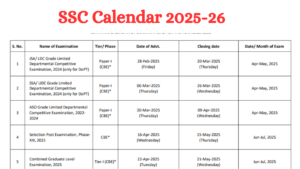

SSC Calendar 2025 Under Review, Dates So...

SSC Calendar 2025 Under Review, Dates So...