Table of Contents

Reserve Bank of India

The Reserve Bank of India has been recognized as the Central Bank of India. It also enacts as the channeling body of national currency. This reputed and leading embark operates and grants the Indian currency, stabilizes the monetary sustainability and maintains the credit system of our country. One of the benchmarking functionalities of the Reserve Bank of India is to generate a systematic regulatory and multi-layered environment to make the policies useful for the audiences. Moreover, this management will make it easy for the banking sector to abide by its streamlined approaches.

RBI is a huge support to establish sustainable economic standards in India. It is the huge umbrella covering every type of bank in our country. In this article, we will talk about all the significant measures of RBI along with its history, structure and functionalities.

What is Reserve Bank of India?

The Reserve Bank of India values its role as a statutory body that functions as the Central Bank of India. The functionalities of the Reserve Bank of India help the economic aspect to be engaging and dynamic for better usage. It also handles all types of monetary policies enriched by the Govt of India. The Reserve Bank of India facilitates all the work policies and manages the soulful functionalities of multiple bank types.

History of Reserve Bank of India

The recent age Reserve Bank of India has fetched reputed fame of being a Central Bank of India. But formerly started its operations as a private shareholder’s banking system.

- Reserve Bank of India took the position of the Imperial Bank of India and initiated issuing the currency notes. Lately, it started satiating the role of a banker to the Govt.

- Imperial Bank of India acted as the agent of RBI after the huge success. Slowly, RBI started covering all the integral parts of India and amplified its presence.

- To acquire authentic knowledge about the monetary policies enrolled by the Govt, it was concluded to nationalize the functionalities of RBI after the Independence era.

- On 1 January 1949, the Reserve Bank of India started functioning as a State-owned Central Bank.

- It was evident to make the Commercial banks highly streamlined. So, Govt. of India ruled on the Banking Companies Act 1949, which was later changed into Banking Regulation Act 1949.

- Moreover, the Reserve Bank of India became the huge territory that manages and controls the financial system with multiple measures to date.

Reserve Bank of India Composition

Terms, regulations and affairs of the Reserve Bank of India functioned by a central board of directors. The Indian Govt acknowledged the directors as per the processing of the Reserve Bank of India Act. Every four years, the directors will be selected by the authorities. Here we are enlisting a broad type of directors.

- Official Directors: These type of directors works in a full-time mode. This group involves Governors.

- Non-Official Directors: These type of directors has been segmented into two sections as listed below:

- Elected by the Government: It involves 2 govt officials, and 10 directors approached from different sectors.

- Others: This group involves 4 directors. Four regional bodies will approach the directors.

Reserve Bank of India in Preamble of India

The Preamble of RBI mentions the necessary functionalities of the Reserve Bank of India. The following Preamble directs all the major regulations that the RBI should follow. This is considered to be a stabilized economic aspect of our country. This is also responsible for functioning the country’s credit system in a genuine manner. Moreover, it also adopts modern monetary effects to channel suitable growth for the demanding changes.

Governor of Reserve Bank of India

Recently the role of Governor for the Reserve Bank of India is handled by Shaktikanta Das. He has formerly served as the Secretary of the Revenue Department, Department of Economic Affairs and Ministry of Finance. He grasped the charge of RBI Governor on 12 December 2018. Here we have enlisted all the 25 Governors of RBI.

| RBI Governors List |

| Shri Shaktikanta Das |

| Dr. Urjit R. Patel |

| Dr. Raghuram Rajan |

| Dr. D. Subbarao |

| Dr. Y V Reddy |

| Dr. Bimal Jalan |

| Dr. C Rangarajan |

| S Venkitaramanan |

| R N Malhotra |

| A Ghosh |

| Dr. Manmohan Singh |

| Dr. I G Patel |

| M Narasimham |

| K R Puri |

| N C Sen Gupta |

| S Jagannathan |

| B N Adarkar |

| L K Jha |

| P C Bhattacharya |

| H V R Iengar |

| K G Ambegaonkar |

| Sir Benegal Rama Rau |

| Sir C D Deshmukh |

| Sir James Taylor |

| Sir Osborne Smith |

| — |

The Governor of the Reserve Bank of India will handle the responsibilities for the tenure of three years.

Functions of the Reserve Bank of India

The Reserve Bank of India acts as the major body that functions as the Monetary Authority that manages foreign exchange and currency. Moreover, it also directs reputed operations for the financial system. In this article, we are enlisting all the leading functionalities rules by the Reserve Bank of India.

- Manages Foreign Exchange: The Reserve Bank of India governs FOREX. It also regulates the authenticity for processing foreign trade and maintaining the monetary values.

- Monetary Authority: Being the major authority of monetary policies, The RBI implements several authentication to stabilize the economic growth of India.

- The currency Issuer: The RBI delivers abundant amount of currency notes to the public to give a prominent value to their quality. it also issues exchanging currency and coins.

- Regulates the financial System: RBI is responsible for for maintaining detailed factors about banking operations. It embarks on several regulations like bank mergers, branch expansion, issuing licenses, liquidity of assets and more.

- Development Steps: The Reserve Bank of India put all the efforts to strengthen the developmental steps of our country.

- Detect market evaluation: The RBI effectively handles the Repo markets, market instruments and money markets. The operations that has to be ruled by the money market has to be implemented by the RBI.

- Major Banker: One of the major functionalities of the RBI involves settling the interbank transactions.

Objectives of The Reserve Bank of India

Some of the exemplary objectives of RBI is regarded for maintaining and safeguarding Public’s confidence and depositor’s interests in the following system. It also facilitates the cost-effective banking services. As per the rulings of RBI Act 1934, we have enlisted all the objectives of RBI.

- To authorize and securing monetary stability in our country.

- To effectively channelize the credit system of India.

- To govern the concerns regarding the bank notes.

- To authenticate central banking functions.

- To encourage economic stability.

Crucial Acts Enacted By The Reserve Bank of India

The RBI has enacted many integral policies and acts that we are enlisting in the below table:

| Acts Implemented by the RBI |

|

|

|

|

|

|

|

|

|

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

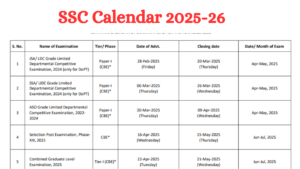

SSC Calendar 2025 Under Review, Dates So...

SSC Calendar 2025 Under Review, Dates So...