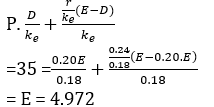

Q1. If the market price of an equity share of PC Ltd is Rs 35, dividend per share is 20%, IRR on investments is 24% and cost of capital is 18%, the earnings per share as per Walter model is

(a) 5.78 Rs

(b) 5.01 Rs

(c) 4.97 Rs

(d) 7.73 Rs

(e) 6.78 Rs

Q2. Which of the following is/ are the essential features of an optimum capital structure? –

(a) Long term solvency

(b) Low debt proportion

(c) Flexibility

(d) Both (a) and (c) above

(e) All of (A), (B) and (C) above

Q3. A negative net float means –

(a) The balance in the books is higher than that of the firms

(b) There are more cheques issued as per the books than that are received

(c) The firm can resort to playing the float

(d) The firm has received cheques for an amount higher that the amount for which it issued cheques

(e) It represents an OD balance as per the firms books

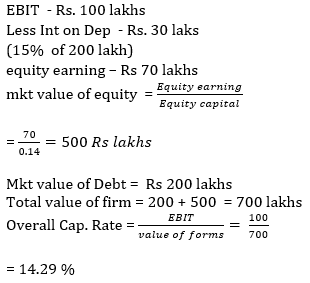

Q4. XYZ ltd is earning an annual EBIT of Rs 100 lakh. The company has Rs 200 lakh of debenture in its capital structure.The equity capitalization rate for the company is 14%. The overall capitalization rate as per the net operating income approach is

(a) 14.29%

(b) 16.57%

(c) 18.15%

(d) 20.15%

(e) 22.33%

Q5. According to Gordon’s model, the optimal dividend payout ratio for a firm whose cost of capital and return on investment are 15% and 12% respectively is

(a) 100%

(b) 80%

(c) 60%

(d) 0%

(e) No relation between dividend payout, cost of capital and return on investment

Q6. While calculating weighted average cost of capital

(a) Preference shares are given more weightage

(b) Cost of issue is considered

(c) Retained earnings are always excluded

(d) Tax factor is ignored

(e) Both (B) and (C) above

Q7. Which of the following is not an assumption of Miller and Modigliani approach –

(a) There are no corporate or personal income tax

(b) Firms can be grouped into “equivalent return” classes on the basis of their business risks

(c) Investors are assumed to be rational and behave accordingly

(d) There is no corporate tax but personal income tax exists

(e) Capital markets are perfect

Q8. Which of the following is not a source of long term finance

(a) Equity shares

(b) Debentures

(c) Preference shares

(d) Commercial papers

(e) Reserves and surplus

Q9. Rights issue is a method of raising funds

(a) By issuing securities simultaneously to the existing shareholders and the public issue

(b) Generally issues to the existing shareholders at a price lower than the current market price

(c) Generally entails lower cost of issue

(d) Generally made to high net worth individuals

(e) Both (B) and (C) above

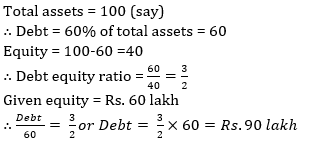

Q10. ABC Co. has financed its assets by taking debt as high as 60% of the value of assets. If the equity capital of the company is Rs. 60 lakhs, then the debt is

(a) Rs. 60 lakh

(b) Rs. 90 lakh

(c) Rs. 120 lakh

(d) Rs. 125 lakh

(e) Rs. 150 lakh

Solutions

S1.Ans.(c)

Sol.

S2.Ans.(b)

Sol. Low debt feature is not an essential feature of capital structure but is company specific.

S3.Ans.(d)

Sol. The period of time between when a bank customer writes a check and when it is cleared. Negative float is the difference between checks written or actual checks deposited as stated in a check register and the checks that have cleared an account according to bank records. A negative float occurs when checks are clearing faster than deposits received into the account.

S4.Ans.(a)

Sol.

S5.Ans.(a)

Sol. Basic gordon model implies dividend payOut to be 100 % when r is less than k . In this question as 0.12< 0.15, therefore the pay out is 100%. r < k = 0.12 < 0.5 = 100 %

S6.Ans.(b)

Sol. cost of issue (flotation) is associated with the cost of external equity capital.

S7.Ans.(d)

Sol. No explanation required

S8.Ans.(d)

Sol. commercial papers are issued for a period of 15 days to one year for financing working capital request.

S9.Ans.(e)

Sol. A right offering (issue) is an issue of rights to a company’s existing shareholders that entitles them to buy additional shares directly from the company in proportion to their existing holdings, within a fixed time period. In a rights offering, the subscription price at which each share may be purchased is generally at a discount to the current market price. Rights are often transferable, allowing the holder to sell them on the open market.

S10.Ans.(b)

Sol.

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

Without These Documents, Your Bank Exam ...

Without These Documents, Your Bank Exam ...