Q1. In an effort to influence the economy, a central bank conducted open market activities by selling government bonds. This implies that the central bank is most likely attempting to:

(a) Contract the economy by reducing bank reserves

(b) Expand the economy through a lower policy interest rate

(c) Contract the economy through a lower policy interest rate

(d) None of these

(e) Expand the economy through a higher policy interest rate

Q2. Which of the following government interventions in market forces is most likely to cause overproduction?

(a) Price floors

(b) Price ceilings

(c) Imposing an additional per-unit tax of Rs1 on sellers

(d) None of these

(e) All of these

Q3. If you wish to compute economic earnings and are trying to decide how to account for inventory, _______.

(a) FIFO is better than LIFO

(b) LIFO is better than FIFO

(c) FIFO and LIFO are equally good

(d) FIFO and LIFO are equally bad

(e) None of the above

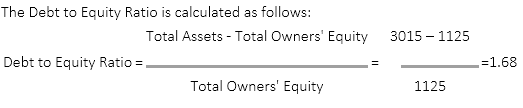

Q4. Calculate the Debt to Equity Ratio given that Total Assets = Rs. 3015 Cr and Total Owners’ Equity = Rs. 1125.

(a) 1.49

(b) 1.68

(c) 1.75

(d) 2.25

(e) 2.42

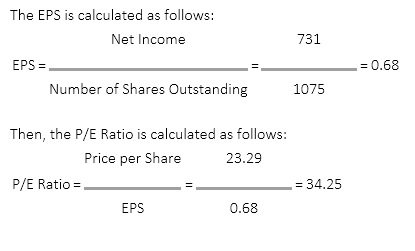

Q5. Calculate the P/E Ratio given that Net Income = Rs. 731 Number of Shares Outstanding = Rs. 1075 and the Stock Price = Rs. 23.29.

(a) 35.82

(b) 34.25

(c) 36.45

(d) 36.95

(e) 34.75

Q6. A firm has a P/E ratio of 12 and a ROE of 13% and a market to book value of __________.

(a) 0.64

(b) 0.92

(c) 1.08

(d) 1.56

(e) None of the above

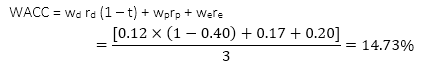

Q7. A firm’s estimated costs of debt, preferred stock, and common stock are 12%, 17%, and 20%, respectively. Assuming equal funding from each source and a 40% tax rate, the weighted average cost of capital is closest to:

(a) 13.9%.

(b) 14.7%.

(c) 16.3%.

(d) 15.8%

(e) 16.5%

Q8. Consumer surplus is best described as:

(a) Always less than or equal to zero.

(b) Always greater than or equal to zero.

(c) At times positive and at other times negative.

(d) Constant at Zero.

(e) None of these

Q9. The following is (are) the external source(s) of cash

(a) Long terms loans

(b) Short term borrowings

(c) Issue of new shares

(d) All of the above

(e)None of the above

Q10. The total cost that arises when the quantity produced is increased by one unit is called

(a) Average cost

(b) Marginal cost

(c) Fixed cost

(d) Unit cost

(e) All of these

Solutions

S1. Ans. (a)

Sol. A central bank Reserve Bank of India conducted open market activities by selling government bonds. This implies that the central bank is most likely attempting to Contract the economy by reducing bank reserves.

S2. Ans. (a)

Sol. Price floors in market forces, government this intervention is most likely to cause overproduction.

S3. Ans. (b)

Sol. If you wish to compute economic earnings and are trying to decide how to account for inventory then LIFO is better than FIFO. LIFO is Last In First Out.

S4. Ans. (b)

Sol.

S5. Ans. (b)

Sol.

S6. Ans. (d)

Sol. E/P = ROE / (P/B); 1/12 = (0.13) P/B; 0.0833 = 0.13/(P/B); 0.0833(P/B) = 0.13; P/B = 1.56.

S7. Ans. (b)

Sol.

S8. Ans. (b)

Sol. Consumer surplus is best described as always greater than or equal to zero.

S9. Ans. (d)

Sol. All of the above

Long terms loans, Short term borrowings and Issue of new shares all are external sources of cash.

S10. Ans. (b)

Sol. The total cost that arises when the quantity produced is increased by one unit is called Marginal cost.

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

World Malaria Day 2025

World Malaria Day 2025