Table of Contents

Different Codes Used In the Banking Sector

Indian banking or financial system is considered to be one of the most efficient sources that facilitate the economic factor of the country. The banking sector encircles a broad range of activities that soothes the financial demands of worldwide customers. Moreover, the dynamic shift of modern attributes made India’s banking system take a swift turn. Different crucial initiatives are getting implemented to increase the pace of the banking sector. One of the most reliable adoptions is the Different Codes Used In The Banking Sector.

Here, we have enlisted some vital codes used in the banking sector to amplify the managing operations. An aspirant must go through these codes if they are preparing for any competitive banking exams. Knowledge of these codes will make them flourish in their career effectively.

List Of Different Codes Used In The Banking Sector

Our comprehensive financial industry utilizes various codes and digits to make the functioning run smoothly in banking sector. Here we have described Different Codes Used In The Banking Sector that elevates the utility of the following industry. These prominent codes has to be remembered by any students who wants to score more in any competitive exams. These codes are said to be one of the integral section in banking exams.

Various Codes Used In The Banking Sector

Here is the list of Different Codes Used In The Banking Sector:

Indian Financial System Code (IFSC)

- IFSC is known to be an eleven character alphanumeric code generated for managing fund transactions in between the banks.

- It is considered to be one of the significant aspect in banking sector as it approaches the money management criteria in our country.

- IFSC has a detailed alignment where it verifies the payee’s and payer’s bank branch and make sure that the transaction has been channelized to the authentic and correct branch.

- The IFSC let the Reserve bank of India trace the transactions happened in between the banks resulting the money transfer to be highly error-free and secured.

- You can check your IFSC printed over the front page of the passbook or on your cheque leaf.

Format of IFSC : IFSC is initiated using around 11 alphabets and numbers. The four initial alphabets indicates to the bank and on the other hand the last 6 digits determine the branch of the bank. The fifth number always remains 0 to use it in future.

Checque Number

- A cheque number is facilitated with 6 digits specifically to identify a cheque. These numbers are printed in between inverted commas right at the bottom of the cheque leaf. You can verify the status of the cheque through the number.

- An individual needs to fulfill certain cheque information when depositing a cheque to someone’s account.

- The following details involve account number, date, cheque number, cheque amount and more.

Format of Cheque Number: A unique combination of six digits will give rise to a cheque number.

Magnetic Ink Character Recognition (MICR Code)

- MICR is considered to be a 9-figure code utilized to sense the geographical location of the banking branch involved in Electronic Clearing Service. MICR is categorized to be a technology specifically used for printing MICR codes over cheques.

- The following code amplifies the fund transfer process by boosting the cheque clearance criteria. With the initiation of MICR code the manual processing has been eliminated. This helps the cheques to stay away from human errors.

- You can see a MICR Code on your cheque leaf or on your savings passbook. This is one of the crucial aspect used under Different Codes Used In The Banking sector.

Format of MICR: MICR is constructed with 9-digits and every bank has an unique MICR code. The first three digit out of the nine indicate the city, the next three digit indicates the bank and the last three digits darts on the branch of the bank.

Society Of Worldwide Interbank Financial Telecommunication (SWIFT Code)

- Out of the Different Codes Used In The Banking Sector, SWIFT is considered to be a valuable one. It is a type of network that channelizes the financial transactions worldwide in a secured manner.

- SWIFT code access the city, country and branch of the respective beneficiary and takes care of the right transaction process.

- The SWIFT Code grasps its positioning over the front side of the passbook.

Format of the SWIFT Code: SWIFT Code is specifically initiated with the utilization of a country code, bank code, branch code and city code. Around 8-11 alphanumeric characters combines to form a SWIFT Code.

Custom Information Number (CIF)

- CIF number can be valued as one of the essential parts of Different Codes Used In The Banking Sector. It is known to be the virtual file of a certified account holder processed by the bank during the account opening session.

- All he details of the account holder like KYC, loans, Demat accounts and more will be mentioned in the CIF.

- Banks holds the access over the CIF number of an account bearer and can retrieve the details if necessary.

- The bank and its customers shares a transparent value through the CIF number. So, fraudulent activities must be avoided.

Format of CIF Number

CIF number can be created as per the regulations and choices of different banks.

These are some of the crucial and Different Codes Used In The Banking sector you must remember to flourish in any type of competitive banking exams.

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

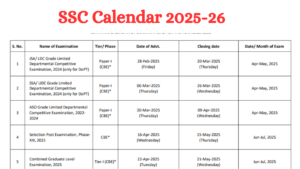

SSC Calendar 2025 Under Review, Dates So...

SSC Calendar 2025 Under Review, Dates So...