Table of Contents

For those banking and financial sector employees seeking to evolve in the dynamic and ever-changing Indian banking sector, the CAIIB (Certified Associate of the Indian Institute of Bankers) exam offers a pathway to unparalleled opportunities and professional growth. CAIIB certification, by the Indian Institute of Banking and Finance (IIBF), goes beyond academic achievements—it serves as a catalyst for financial benefits, career progression, and personal development within the banking industry. In this article, we have discussed in detail the benefits after clearing CAIIB Exam.

List of Benefits After Clearing the CAIIB Exam

In the banking and finance sector, clearing the CAIIB Exam is considered akin to achieving graduation, as it’s a promotion-oriented examination. Below, we’ll explore the financial and non-financial rewards that follow success in the JAIIB and CAIIB exams.

Also Read, CAIIB Admit Card 2024

1. Increment in Salary

In Public Sector Banks, officers who pass the CAIIB exam qualify for extra increments, whereas clerks, supervisory staff, and officers are entitled to two increments.

For older-generation private sector banks like Federal Bank and Karnataka Bank, joining the IIBF is similar to receiving increments in public sector banks. However, in modern private sector banks such as HDFC Bank and Yes Bank, career advancement is tied to performance. Therefore, clearing the CAIIB exam in these banks may result in additional responsibilities that could lead to increased rewards based on individual performance. This principle also applies to Non-Banking Financial Companies (NBFCs).

2. Increase in Allowances

When there’s an increase in your basic pay, other allowances such as:

- Traveling Allowance (TA)

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Conveyance Allowance

- Deputation Allowance

- Medical Allowance

- Refreshment Allowance

- Daily Allowance

- Child Care Allowance

All these allowances are calculated on basic pay of the employees so this results in a significant enhancement of your overall compensation package.

3. Greater Promotion Opportunities

Obtaining the CAIIB (Certified Associate of the Indian Institute of Bankers) certification offers a substantial competitive edge when it comes to internal promotions within the banking sector. Banking institutions actively seek out candidates who have demonstrated a dedication to professional growth and acquired specialized knowledge. The CAIIB certificates serve as a testament to an individual’s commitment to enhancing their skills and expertise, making them prime candidates for crucial roles and positions within the organization. These certifications signify a banker’s proactive approach to personal and professional development, a trait highly valued by employers in the dynamic banking industry.

4. Enhanced Knowledge

The certifications of JAIIB and CAIIB offer comprehensive insights into banking, finance, technology, and associated domains. This enriches your expertise and enhances your value within your organization.

5. Growth in Pension Fund

With the increase in income that comes with obtaining the CAIIB (Certified Associate of the Indian Institute of Bankers) certification, there is a corresponding rise in the amount contributed towards an individual’s pension fund. Upon gaining insights into the financial rewards associated with these prestigious certificates, it becomes evident how they can serve as a catalyst for professionals to attain new milestones and elevate their career trajectories within the banking sector. The CAIIB certification not only unlocks monetary benefits but also paves the way for career advancement opportunities, enabling bankers to reach greater heights in their professional pursuits.

6. Access to Specialist Roles

Passing the CAIIB Exam unlocks opportunities in specialized departments within the banking sector, such as Treasury, Forex, and Risk Management. These departments actively seek individuals with advanced qualifications, presenting avenues for career advancement. Positions in these areas typically offer higher salaries, making them appealing options for banking professionals aiming to progress in their careers.

7. Internal Mobility

Successfully clearing the CAIIB exams enhances your prospects of transitioning into your preferred departments, broadening your experience and job satisfaction. As you’re introduced to opportunities for career advancement, we recognize the role CAIIB certifications play in augmenting your skills and expertise.

8. Better Decision-Making Skills

The comprehensive knowledge and expertise gained through the process of obtaining these prestigious certifications directly contribute to enhancing an individual’s decision-making capabilities in their day-to-day professional responsibilities. As a result, bankers experience a notable surge in their confidence levels and overall proficiency in executing their tasks. The in-depth understanding acquired through the certification process equips them with the necessary tools to make well-informed decisions, ultimately leading to improved performance and increased competence in their respective roles within the banking sector.

9. Salary After Clearing CAIIB

According to the guidelines set by the Indian Bank Association, permanent employees of public sector banks who pass the CAIIB examination are entitled to salary increments based on their CAIIB qualification. After CAIIB certification there are two increments in basic pay of both clerk and officers.

What are the Benefits of CAIIB in Private Banks?

The Certified Associate of the Indian Institute of Banking (CAIIB) certification is a valuable credential for professionals in the banking sector, and private banks are no exception. Earning a CAIIB certificate demonstrates a commitment to professional development and equips the banking and financial sector employees with a strong foundation in key banking areas. Here’s how a CAIIB certification can benefit career in private banking:

- Enhanced Credibility: The CAIIB designation is recognized by private banks as a mark of expertise. It showcases in-depth knowledge of banking principles, regulations, and practices, making one a more attractive candidate.

- Specialized Skillset: The CAIIB curriculum covers a wide range of topics relevant to private banking, including wealth management, risk management, and customer service. This specialized knowledge allows employees to better serve their clients and navigate the complexities of private banking.

- Career Advancement: Private banks often prioritize promoting individuals with industry certifications like CAIIB. This qualification can open doors to leadership positions and specialized roles within the bank.

- Salary Boost: Many private banks offer salary increments or allowances for employees who hold the CAIIB certification. This translates into improved compensation and career growth potential.

- Lifelong Learning: Pursuing the CAIIB demonstrates a commitment to continuous learning, a crucial quality in the dynamic world of finance.

Investing in professional development with the CAIIB certification can be a game-changer for a private banking career. It signifies employees’ dedication to the industry, enhances their skillset, and positions them for success.

Some Other Benefits of Clearing CAIIB Exam

Besides monetary benefits, various other benefits of CAIIB certification enhance the employability of the employee. Some of them are discussed below:

Professional Recognition: Obtaining the JAIIB (Junior Associate of the Indian Institute of Bankers) and CAIIB (Certified Associate of the Indian Institute of Bankers) certifications enhance your professional standing among colleagues and solidifies your reputation within the banking industry. These achievements not only garner admiration from your peers but also serve as a testament to your expertise and dedication to the field, positioning you as a credible and respected professional in the banking sector.

Skill Development: In the ever-evolving banking landscape, staying ahead of the curve is paramount for professionals seeking career advancement. The Certified Associate of the Indian Institute of Bankers (CAIIB) examination stands as a beacon of excellence, offering a comprehensive pathway for skill development and professional growth.

Networking Opportunities: In the ever-changing landscape of the banking industry, networking is not just a luxury but a necessity. By clearing the CAIIB examination, professionals unlock a world of opportunities to forge valuable connections, stay ahead of the curve, and pave the way for career growth and success.

| Related Posts |

|

| CAIIB Syllabus 2024 | CAIIB Exam Date 2024 |

| CAIIB Salary 2024 | CAIIB Eligibility Criteria 2024 |

GA Capsule for SBI Clerk Mains 2025, Dow...

GA Capsule for SBI Clerk Mains 2025, Dow...

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

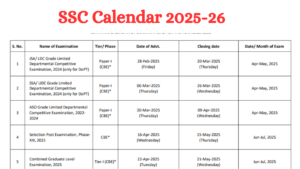

SSC Calendar 2025 Under Review, Dates So...

SSC Calendar 2025 Under Review, Dates So...