Table of Contents

Bank Cheques: A Brief Description

A cheque is considered to be an important piece of document or paper that verifies the orders to a bank to transfer certain amount from the bank account of an organization or an individual to specified bank account. The person who initiates or writes the cheque is known to be the Drawer and the person whose name will be written on the cheque is known to be the payee. A cheque consists of the amount of money that has to be transferred along with the date, payee’s name, and signature of the drawer.

Important Points About Bank Cheques

Here, we have listed some points that an individual should understand about the utility of Bank Cheques.

- A cheque should be issued against a savings or current bank account with high authenticity.

- If the cheque will not consist of all the details, it will be considered invalid.

- The power to encash the cheque has been given to the payee only.

- Every cheque holds a 9-digit MICR code, which makes the clearance of cheques much easier for the banking organizations.

- A cheque will be valid for 3 months starting from the date it has been issued to a payee.

What is the Purpose of Bank Cheques?

The purpose of a cheque, which is a negotiable instrument, is to ensure smooth monetary transactions as per the required specifications. Today, cash is the widely used method of payment, but if somebody has to make the payment on future date then the cheque is the best payment method. Based on different factors, we have different types of cheques. Let’s have a look at them.

Different types of Bank Cheques

Listed below are the different types of Bank cheques you must be aware of.

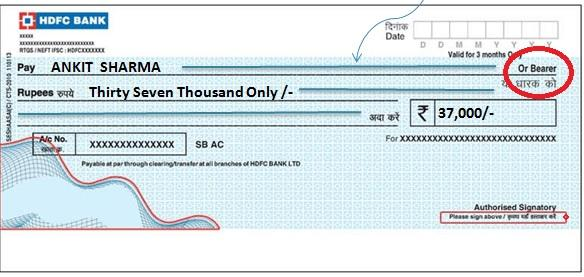

Bearer Cheque

A bearer cheque is a cheque which is payable to the bearer of the cheque or whose name is written on the cheque. A bearer cheque has “or bearer” printed at the end of the dotted lines, which is meant to have the name of the drawee. This feature of this cheque is that it can be presented over the counter of the drawee bank and is payable to the one giving it. It is an easily transferable instrument and thus can be passed on to another by mere delivery. That is why these cheques are not considered to be secure.

Image Source: ask.careers

Order Cheque

Order cheque refers to the cheque in which the printed word “bearer” is canceled, thereby making it payable only to the person whose name is written in the place of drawee. Once the drawer canceled the “bearer” on the cheque, it is automatically understood that this is an order cheque, and the bank is directed to only complete the transaction once they have identified, to their satisfaction, the bearer of the cheque as the same person, as named in it.

Image Source: flickr.com

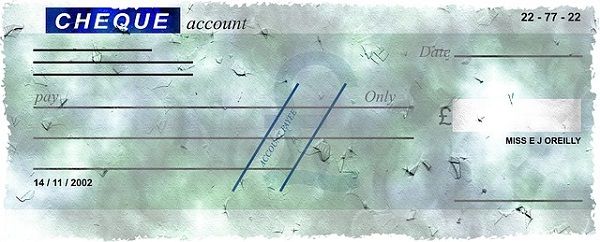

Crossed Cheque

A crossed cheque refers to the cheque in which the drawer makes two parallel transverse lines at the top left corner of the cheque. He may or may not mention “a/c payee.” By doing so, it makes sure that no matter who presents the cheque to the drawer bank, the transaction is made into the account of the person named in the cheque only. This type of cheque is considered to be safe as it reduces the risk of money being given to an unauthorized person because this type of cheque can only be cashed by the drawee’s bank.

Image Source: Quora

Open Cheque

Open cheques refer to the cheque that is not crossed. That is why it is also known as uncrossed cheque. This cheque can be presented by anyone whosoever found it or get it to the drawer’s bank and get the payment. The person having this cheque can further transfer it to another person and can easily make him the drawee. This cheque can only be opened by not cutting the word open. Also, the person who is issuing the cheque must ensure his/her signatures on both the front and the back of the cheque. Otherwise, a bank can deny the payment to the payee. The bank also makes the payee sign at the back of the cheque while receiving the amount.

Source: Quora

Post Dated Cheque

A cheque is referred to as a Post Dated Cheque when it is bearing a later date than the one on which it is issued. The person can present this cheque at any time at the bank, but no transaction will take place before the date mentioned. If you submit this cheque after the date mentioned on the cheque, it will still be valid, and you can still make the payment.

Stale Cheque

A stale cheque refers to a cheque which is past its validity period and can no longer be encashed. Earlier, the period was six months from the date of issue. Now, this period has been reduced to three months. So, any cheque becomes a stale cheque if it is not encashed before three months after its issuance.

Travelers’ Cheque

Travelers’ Cheques are considered or are equivalent to a universally accepted currency. This cheque is available almost everywhere and comes in various denominations. This cheque acts as an instrument issued by the bank itself to make payments from one place to another. The pros of this cheque are that there is no expiry date of a traveler’s cheque and thus, it can be used during your next travel as well, or you have the option to encash it once you land back in India.

Image Source: researchgate.net

Image Source: researchgate.net

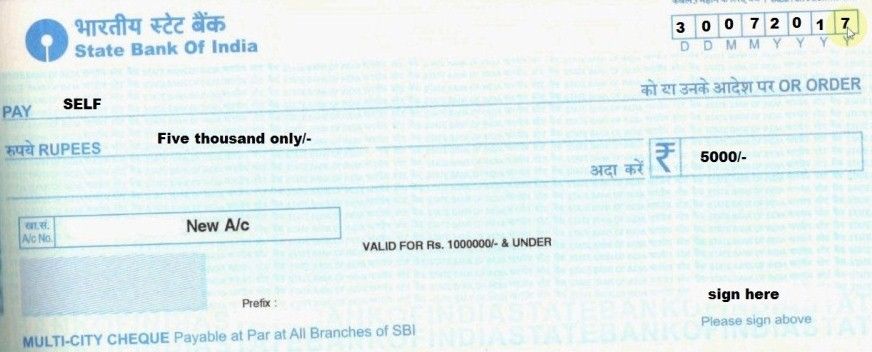

Self Cheque

A cheque is the cheque where the drawer usually issues a self-cheque to his or herself. The name column should be filled with the word “self”. Any person can issue a self cheque when the drawer wishes to withdraw money from the bank in cash for his use. A self cheque can only be encashed in the account holder’s or the drawer’s bank. It is important to take precautions with this cheque as if it is lost, another person may easily get it encashed by visiting the drawer’s bank.

Image Source: bankindia.org

Mutilated Cheque

Mutilated Cheque refers to the cheque which is torn into two pieces or mutilted. In such type of cheque case, the bank does not make payment unless they get a confirmation from the drawer.

Image Source: keydifference.com

Ante Dated Cheque

If the respective drawer signifies a date prior to the current date on a cheque, it is considered to be a Ante Dated Cheque.

Blank Cheque

When the cheque will consist of only drawer’s signature and all the important fields will be remained empty, it is known to be a blank cheque.

Benefits of Bank Cheques

There are numerous features of Bank Cheques an individual must be careful about. Here, we have listed some pointers through which you can understand more about this payment mode.

- A cheque’s payment will always be in cash.

- A cheque is considered to be an unconditional order.

- A cheque can be accessed through a particular bank.

- The exchequer should hold the signature and it is a mandatory functionality.

These are some of the essential points a candidate who is preparing for any banking exam should be aware of. Most of the banking exams asks questions related to the types of Bank Cheques. So, you should know the types and there features as mentioned in this article.

IBPS Final Result 2025 Coming Out Tomorr...

IBPS Final Result 2025 Coming Out Tomorr...

Simple Tips to Avoid Common Mistakes In ...

Simple Tips to Avoid Common Mistakes In ...

Important Topics & Shortcuts for IDB...

Important Topics & Shortcuts for IDB...