(a) State cooperative banks

(b) Regional rural banks

(c) Commercial bank

(d) All of the above

(e) None of the above

Q2. Kisan Credit Cards are an effective way of reaching out to the farmers by the banks. What assistance does the farmer receive in this way?

(a) Credit facility for crops etc against an approved limit

(b) Short-term credit facility against value of his crops

(c) Long-term credit is provided against his land holdings

(d) Loan is permissible against crops sold, but payment yet to be received by the farmer

(e) None of the above

Q3. Which of the following is true?

(a) NBFCs can accept deposits from the public

(b) NBFCs cannot offer deposit schemes to the public

(c) Deposits of NBFCs are insured with DICGC

(d) NBFCs can accept deposits from public if they are registered and permitted by RBI

(e) None of the above

Q4. Base rate is the rate below which no bank can allow their lending to anyone. Who sets-up this ‘Base rate’ for banks?

(a) Individual Banks’ Board

(b) Ministry of Commerce

(c) Ministry of Finance

(d) RBI

(e) Interest Rate Commission of India

Q5. The financial assistance of loans of Rs.10000 by bank to a small borrower will be called……….?

(a) business finance

(b) government finance

(c) micro finance

(d) small finance

(e) KYC finance

Q6. The Aadhar-Enabled Payment System (AEPS) is a bank-led model that facilitates banking facilities through banking correspondents across banks. However, Aadhaar-enabled basic types of banking transactions do ‘not’ include?

(a) Aadhaar to Aadhaar funds transfer

(b) small overdraft facility

(c) cash withdrawal

(d) balance enquiry

(e) cash deposit

Q7. A type of fraud where in criminals use an innocent person’s details to open or use an account to carry out financial transactions, is known as?

(a) identity theft

(b) hacking

(c) money laundering

(d) espionage

(e) phishing

Q8. The part of a company’s earnings or profits which are paid out to shareholders, is known as-

(a) capital gains

(b) taxes

(c) interest on borrowings

(d) dividends

(e) penal interest

Q9. NABARD is responsible for regulating and supervising the functions of

(a) Investment and Industrial Finance Banks

(b) Cooperative Banks and Regional Rural Banks

(c) Corporate Finance and Overseas Banking Units

(d) Private Sector and Multinational Banks

(e) Reserve Bank of India

Q10. The government of India has announced a ‘Funding for Lending’ scheme. Who are the beneficiaries for this scheme?

(a) Commercial Banks

(b) Regional Rural Banks

(c) Micro-finance Institutions

(d) Finance Departments of the State Governments

(e) None of the above

Q11. As per the reports, the collection of direct taxes has gone up by about 19% in last few months. Which of the following agencies releases the figures about tax collection?

(a) Central Statistical organisation

(b) Reserve Bank of India

(c) Department of Income Tax

(d) Central Board of Direct Taxes

(e) None of the above

Q12. As we know commercial banks accept deposits from the public. What do banks do with this money?

(a) This is a type of credit creation. Bank gives this on loan

(b) This is an income for the bank

(c) Banks give this money directly to the govt for developmental projects

(d) This money is deposited with the RBI who in turn gives some interest on it banks

(e) None of the above

Q13. Which of the following in NOT a type of cheque issued by an individual?

(a) Bearer cheque

(b) Order cheque

(c) Crossed cheque

(d) Savings cheque

(e) None of the above

Q14. Which of the following terms is used in banking?

(a) Vacuum

(b) Power

(c) Density

(d) Credit Card

(e) None of the above

Q15. “Sensitive Index” of Bombay Stock Exchange is called ……………?

(a) Forex

(b) MAX

(c) LIBOR

(d) Sensex

(e) None of the above

- Banking Awareness Questions- Quiz for Bank Exams

- National Static Awareness

- International Static Awareness

The Hindu Review October 2022: Download ...

The Hindu Review October 2022: Download ...

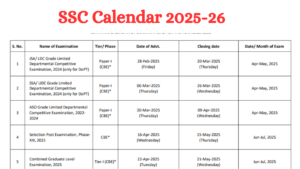

SSC Calendar 2025-26 Out, Check SSC CGL,...

SSC Calendar 2025-26 Out, Check SSC CGL,...

IRDAI Assistant Manager Score Card 2024 ...

IRDAI Assistant Manager Score Card 2024 ...